Transformer ‘changing the game’… Targeting the global market⑤·(End) Sp…

페이지 정보

본문

(Series) Transformer ‘changing the game’… Targeting the global market ⑤·(End) Speed battle to find a second sales channel ‘key’ to strengthening export competitiveness

As overseas expansion of transformers becomes more active, starting with the North American market, domestic companies are speeding up their efforts to improve their technological prowess and devising their next plans. In particular, they are busy seeking a second export market after the US.

Companies that made a soft landing in the US market, which was difficult to enter due to strict standards, are now putting in effort to strengthen their technological prowess in order to maintain their export competitiveness.

Han Sang-wook, CEO of Dongmi Electric, said, “Demand is expected to exceed supply for the next five years, so many companies will be able to enter the US market, but after that, the volume will decrease, so only companies with technological prowess based on high product reliability will be able to continue to do business with the US Power Authority.” He diagnosed, “The US has diverse specifications and each state has different specifications. In particular, companies that can actively respond to their own design capabilities or US standard specifications will be able to survive in the future market.”

The conservative nature of the US market makes it difficult to easily change companies due to price competition, which is also an important factor in securing technological competitiveness for domestic companies. The shortage of supply in North America is leading to an increase in overseas expansion for the time being, but the industry consensus is that if they do not have the technological prowess, their results will only be short-term.

According to the industry, following this trend, domestic heavy electric equipment companies are participating in the IEEE PES T&D, the largest power industry exhibition in the U.S., in large numbers this year. This is interpreted as a strategic decision to acquire advanced technologies and make investments.

However, as the temperature difference between the metropolitan area and regional energy valley companies in terms of overseas expansion is large, there are also voices saying that in order to vitalize domestic transformer exports, it is urgent to create conditions such as government and association support measures so that small and medium-sized power equipment companies can boldly invest in expanding manpower and facilities.

In addition, there is a movement to seek second and third export markets as a plan after the North American market. Leading companies that have advanced overseas, such as Sungjin General Electric and Elpowertech, are reportedly reviewing plans for the next North American market, including expanding factories and manpower.

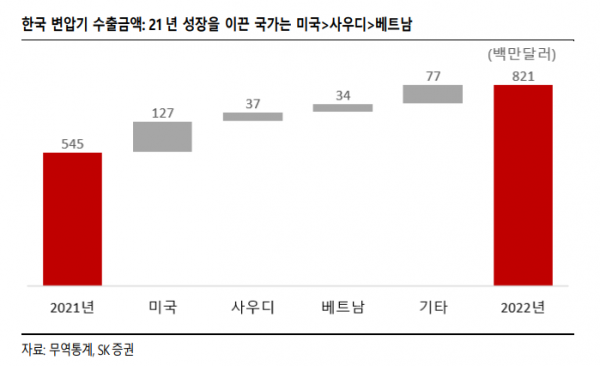

The major target markets are Europe, the Middle East, and Southeast Asia. The US accounts for 25-35% of Korean transformer exports, and the Middle East is also an important market with a share of 10-30%. According to trade statistics, the domestic transformer export amount in 2022 was $821 million, a 51% increase from the previous year. When broken down by country, exports to the US, Saudi Arabia, and Vietnam increased, leading the overall transformer exports.

An industry insider said, “The Middle East is currently actively investing in urban development, so it is drawing attention as a new overseas market,” and “Based on the North American export performance, if we start exporting ‘Team Korea’ as a package for the entire power line, not just transformer exports, I think we will be able to enter the European market where local companies have strong power.”

In addition, attention is also being paid to Vietnam, which is emerging as an emerging market. As Vietnam’s power consumption increases, transformer exports are also increasing, and basically, transformer demand follows power consumption. Vietnam’s population structure is also an important indicator. As of 2020, the total fertility rate was 2.1. This is a high figure compared to China's total fertility rate of 1.3, and when looking at the population pyramid, Vietnam's electricity consumption is expected to increase.

In addition, as domestic transformer companies that focused on exporting to the Philippines are moving to North America or increasing their presence in the US, the plan to use the Philippine market as a springboard to advance into advanced markets is being discussed as a major strategy for companies that have difficulty advancing into the US right away.

According to the industry, the Philippines is the only market in Southeast Asia that excludes China due to quality issues, and is therefore considered an important market for opening up exports.

Choi Seong-kyu, CEO of Elpowertech, said, “Many major domestic transformer companies have entered the Philippine market, but now that they have been absorbed by the U.S., latecomers have the opportunity to enter the Philippine market.” He added, “However, even within the Philippine market, it is divided into high-end markets such as government offices and markets with lower profitability, so competitiveness must be supported.”

Source: Electric Newspaper(https://www.electimes.com)

관련링크

-

https://www.electimes.com/news/articleView.html?idxno=335720

1432times connection

- Previous postTransformer Association, Chairman Choi Seong-gyu succeeds in 4th term… “Association, Activation of Global Standards” 24.05.07

- Next postTransformer ‘changing the game’… Targeting the global market④ How long will the boom last? Everyone rushes to expand production lines 24.04.17

댓글목록

There are no registered comments.